- The EIF and InvestEU

- Past and upcoming InvestEU events

- Guarantee products

- Guarantee products – calls for expression of interest

- Guarantee products - Member State compartment

- Equity products

- Equity products – calls for expression of interest

- ESCALAR – call for expression of interest

- Climate and Infrastructure Funds

- Climate and Infrastructure Funds – call for expression of interest

- Capacity building investments – Call for expression of interest

Equity products

For equity and private credit funds

We’re deploying equity investments across five Thematic Strategies to deepen and develop the market, address Horizontal Priorities and to attract private investment. These equity instruments support venture capital, private equity and private credit funds.

In addition, the separate Climate and Infrastructure Funds bring targeted financing to fund managers and projects in this specific segment.

In addition, the separate Climate and Infrastructure Funds bring targeted financing to fund managers and projects in this specific segment.

Our interactive brochure on InvestEU, including a more detailed summary of the equity product, commercial terms and application process is available in our digital library.https://engage.eif.org/investeu/equity

Thematic strategies

Capital Markets Union

Investments supporting capital markets and improving access to finance-based equity and debt investments that support the growth of European enterprises, diversification of sources of financing, and strengthening the solvency of enterprises by sharing risk with private investors. For investments that fall into the following categories:

- Growth and expansion funds

- Debt and hybrid equity-debt funds

Enabling Sectors

Investments in sectors and industries that support the advancement of the European economy in enabling sectors by facilitating and accelerating the access to finance of enterprises, projects, initiatives and innovators operating in critical industries/sectors. These investments are expected to contribute to increasing the EU’s competitiveness by driving the development, commercialisation and scaling-up of innovation in sectors driven by strategic technologies, in particular:

- Life sciences and health

- Space

- Defence

- Industrial technologies

- Industrial chips

Climate and Environmental Solutions

These investments contribute to the EU Green Deal and support a transition to an EU climate-neutral economy based on sustainable development, a reduction in dependence on fossil fuels, sustainable management of natural resources, food security and enhanced climate resilience, among other goals. Target areas are for example:

- Mobility and transport solutions

- Energy and built-environment solutions

- Industrial decarbonisation & environmental sustainability

- Agriculture, food, natural capital preservation and use of land resources

- Blue economy

- Other adaptation solutions

Digital & Cultural and Creative Sectors

Investments that contribute to the strengthening of the EU’s competitiveness, digital independence and strategic autonomy, with a focus on data, communications technologies, services and products that facilitate the digital transition and address societal challenges, including:

- Artificial Intelligence (AI)

- Blockchain and Distributed Ledger Technologies (BT/DLT)

- Cybersecurity

- Quantum Computing

- Cultural and Creative Sectors (CCS)

- Education Technology

- Other digital

Social Impact

Investments aimed at supporting social enterprises, social sector organisations or impact driven enterprises delivering social impact in their path to scale and creating a conducive environment for risk capital investment in the social impact investing space, including in the field of skills and education, such as:

- Social Entrepreneurship

- Social Impact Investing & Social Innovation

- Skills and Education

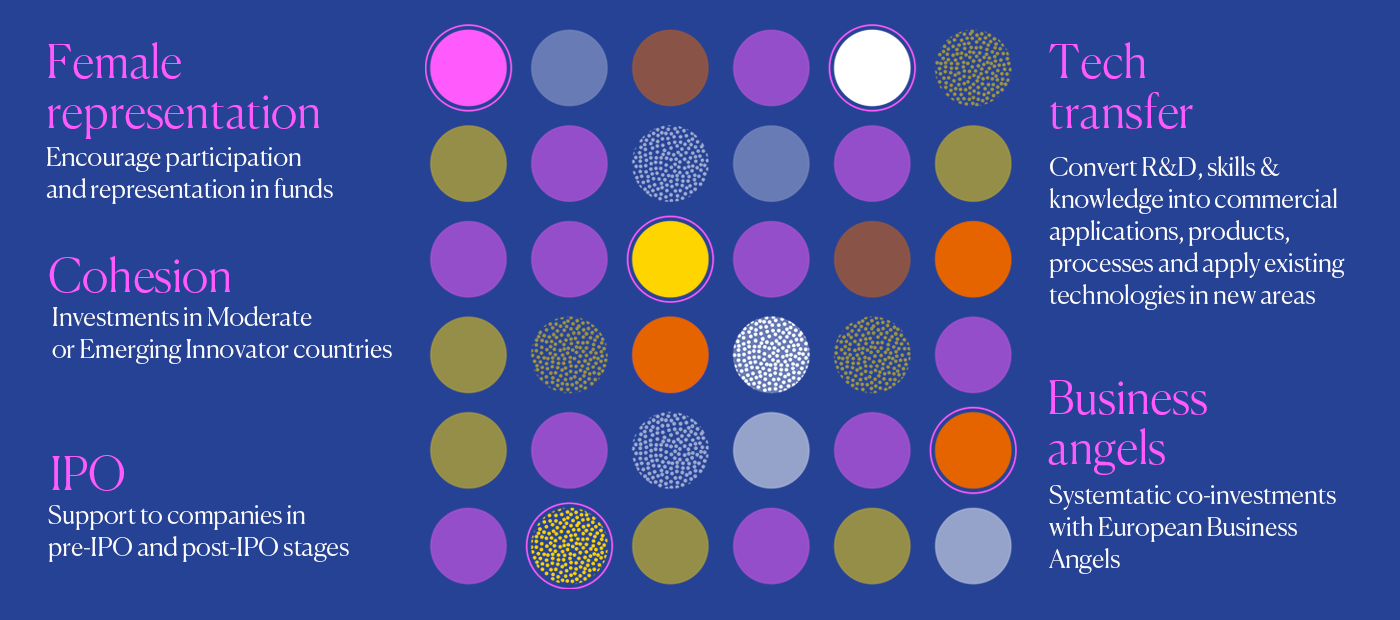

Horizontal priorities

These are additional goals supported by all our InvestEU initiatives. They may contribute to the positive assessment of an investment proposal from fund managers; however, are not exclusive criteria within the EIF’s decision-making process.

How to apply?

The EIF selects financial intermediaries based on a call for expression of interest and a standard selection process including due diligence. The call for expression of interest and the online application form are available here.

Note: Following the recent withdrawal of the United Kingdom from the European Union, we are updating the relevant EIF.org pages.

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.